How To Validate Your Startup Idea

You have a startup idea. Awesome. Thanks to Silicon Valley, and the HBO show Silicon Valley, everyone’s grandma, mailman, dog-sitter, and best friend’s cousin is convinced that they have the next billion dollar idea. However, when it comes to startup ideas, many find that it is easier said than done.

You could be the next Pied Piper… is that a good thing or a bad thing?

We generally went through the following process for launching each product:

- Validate the Market

- Build a Minimum Viable Product (MVP)

- Launch

- Acquire Users

- Collect Data/Feedback

- Pivot & Repeat

So, if you are bullish on that idea for a puppy social networking app or Uber for a well prepared steak (both real ideas that were pitched to me), it’s probably time to roll up your sleeves and get to work.

To cover the “How To’s” of this whole process in one post would probably put you to sleep. So for sanity purposes, let’s first explore how to Validate the Market in this article. Here are some of the tips, tricks, and tools that I recommend to test your startup idea.

- Market Validation

For those new to startup terminology, market validation refers to a series of interviews, or other data, that test a product concept against a potential target market (business or consumer). I like to think of market validation in two stages: Secondary Research and Primary Research.

1.1 Secondary Research

Secondary research is just a fancy way of saying reading other people’s research: articles, white papers, studies, statistics. For the purpose of startup research, I tend to think that competitive analysis and general research should be the main focus.

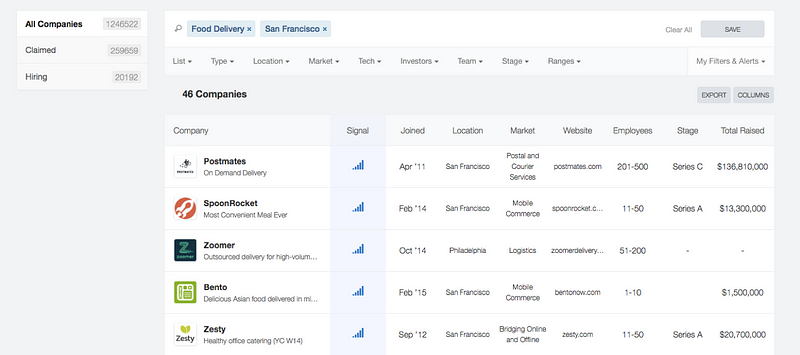

If you have a good idea, it’s very possible someone has had the same idea and executed, or tried to execute on it, so competitive analysis is important. The first thing to do is Google search keywords/terms around the idea paired with the word “startup”. From there, you can dig into publications that cover startup news (i.e. TechCrunch, Mashable, and VentureBeat) andCrunchBase and AngelList. AngelList has a database feature to search all the startups in a given space, so you can get a feel for competitive landscape.

AngelList has an awesome database. Great for competitive analysis.

After a competitor search, try to read up as much as you can on the topic. News publications, research papers, white papers from businesses, blog posts, legal docs, legislation surrounding the issue, etc. are all good resources. This research should either poke a hole in your idea, or give you a sense of its potential pain point and user base.

1.2 Primary Research Design

Primary research is research that you conduct yourself. This is usually data (both qualitative and quantitative) that you collect from surveys, interviews, email outreach, click tracking, etc.

Here is a potential way to design your research survey:

-Write a list of hypotheses to prove that your idea is validated:

I.e. people have serious frustrations around parking in San Francisco.

I.e. people will trust a stranger from a startup to park their car for them.

I.e. people will be willing to pay between $20-$40 USD to have their car valeted.

-Write a list of unbiased questions to survey consumers/businesses to see if your hypotheses are valid:

I.e. Can you describe your parking experience in San Francisco?

I.e. Have you ever used valet services?

I.e. How much would you pay to have your car valeted?

-Find a sample of consumers/businesses to survey. Options for finding a sample:

-Personal social media outreach

-Email outreach (greater detail below)

-In person canvassing

-Events

-Paid Surveying (i.e. Survata)

As startup accelerator Y-Combintator advises, you need to “Make something people want.”, usually by solving a strong pain point for businesses or consumers (i.e. Stripe and payment processing) or “10x-ing” an existing experience. (i.e. Uber and taxis). The goal of these surveys is to make sure that you are solving an actual pain point for people, instead of building an app or business that you think would be useful.

Very Important: When you administer the survey/questions, do NOT tell them about the idea or product until the entire survey is complete, then start a new set of questions after they have heard about the product. You want unbiased answers. In terms of volume; the more interviews, the better, but I would say between 25–50 is a good number. Collect and analyze considering both the quantitative and qualitative interview data.

I’ll distinguish between methods for consumer primary research and B2B primary research for B2C and B2B companies:

Methods for Consumer Primary Research

For administering your survey to consumers, personal social media outreach, in-person canvassing, and events are all good outlets. It’s important to make sure that your interviewees are not biased, so while friends of friends on Facebook are okay, direct connections are not.

Although in person canvassing may feel awkward, it can be integral to understanding your users and quickly validating your idea. Online pharmacyScriptDash validated initial need for their business by interviewing women going into Walgreen’s, and asking them about their birth control purchasing habits.

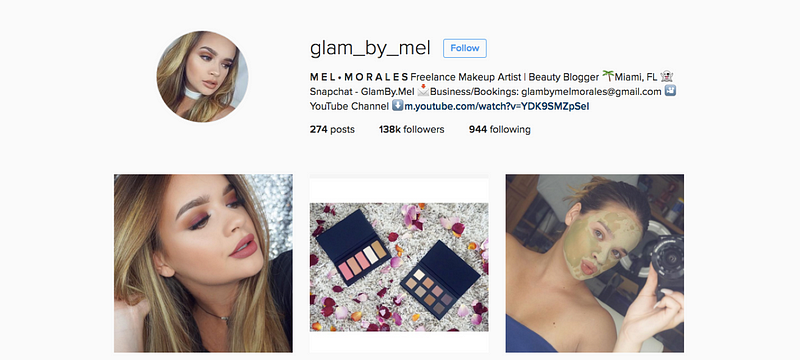

While email isn’t a viable outreach channel for consumers, it is for the people who the influencers and bloggers who command an audience. Cruise Instagram, YouTube, and Facebook for people with large followings who champion the topic that your startup focuses on. They can provide great insight into the industry, consumer trends, and how your target audience thinks.

183,000 followers and the email is in the bio section.

Most influencers leave their contact info in their bio/about section so brands can contact them, or you can reach out via direct message on the platform. Bloggers often leave their contact info on their website. In my next post, I will go into greater depth on how to get the contact info for influencers and bloggers in mass using web-scraping and outsourcing techniques.

Aside from interviews and survey data, you can gauge consumer interest by tracking clicks on online advertising. Of course, because you have no product, you will have to create some “fake” ads as a test, and Facebook is a very friendly platform for this.

An example of a Test Facebook Ad, for an idea our team worked on this year.

When creating fake Facebook Ads, try putting $50–200 USD into paid ads as a lifetime budget, and set your schedule for 2 days. Key metrics are:

- Clicks: Click Through Rate can be used to validate interest. Willingness to migrate from relevant free content to a company page is a good sign.

- Cost Per Click: A low CPC shows that it’s easier to find consumers that are interested in your offering/product/company.

- Reach: Less interesting because it doesn’t measure engagement, but shows the breadth of your market on FB.

Ads can lead to a temporary landing page (30 day free trial with Instapage) with an email collection form. If consumers are entering their email information for pre-signup or submitting questions through a form, that’s a really good sign! If there are lots of clicks to the site, but no site activity, then your bounce rate is high, which would be normal for a temporary landing page, but very bad for a real product page.

While test ads and test landing pages are good for a few days, running them long term can be bad for your brand, so make sure that you turn them off when you have the data that you need.

Methods for B2B Primary Research

Luckily for you, I don’t think that business people even have landlines anymore, so cold calling isn’t really a viable channel for getting a hold of B2B product decision makers. Email is really the best way to communicate with business connections and potential users, so email outreach is the strongest approach for our purposes.

Before you start contacting people, make sure to answer these three questions:

- What kind of companies need this product? (certain industry? particular region?)

- What size are these companies? (number of employees? revenue?)

- What are the possible titles of the decision makers, for your product, in these organizations?

In answering these questions, create or find a list of companies that would need your product, the correct point of contact (decision makers) at those companies, and the email address for that contact. In my post on how toAcquire Users, I will give in depth instructions on how to get email contact information, but if you need to get started immediately, I recommend either reading the book Hacking Sales by Max Altschuler, enrolling in a trial period with ZenProspect, or checking out the SellHack Chrome Extension.

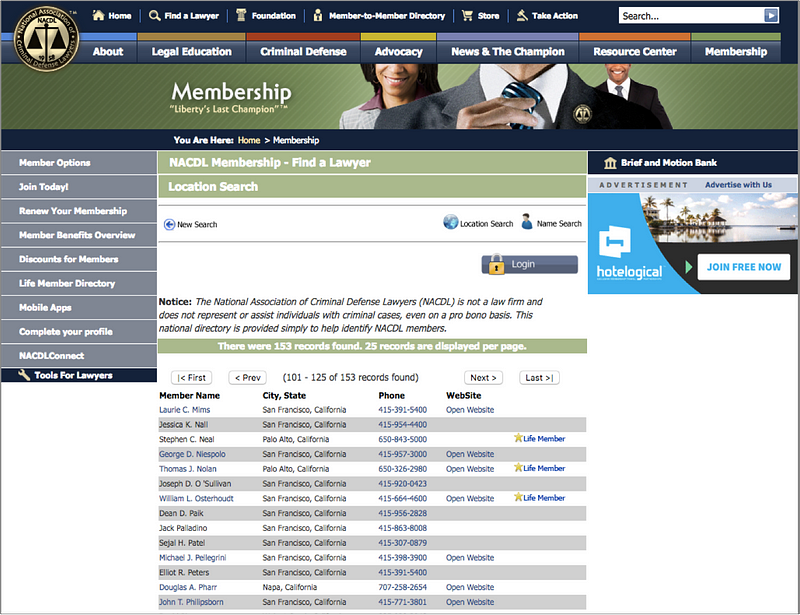

For very small businesses and professionals, i.e. lawyers, doctors, personal trainers, etc., the best way to find a big list of them, and possibly their contact info, is by finding out an institution or association that they are affiliated with. These institutions often have a database associated with them that can be mined for data.

For example, the National Association of Criminal Defense Lawyers lists the phone numbers and websites (which in turn have email addresses) for all criminal defense attorneys.

National Association of Criminal Defense Lawyers database, and lots of attorney contact info.

When crafting your email, the subject line “{contact first name} — quick question” generally yields a 90%+ Open Rate after 3 emails are sent. Email content should be extremely brief: 2–3 sentences. Avoid formal language and buzzwords The goal is not to sell your product, but them to answer your research questions via email or on the phone.

As a test, run 3 small outreach email campaigns to various business verticals that might have interest. (More detail on email outreach in my post on how to Acquire Users). Key metrics are:

- Response Rate: if businesses are willing to engage in a conversation, that’s a good sign. This is the start of a sale.

- Objection Rate: If all of them respond and are unwilling to talk to you or vehemently not interested, bad sign.

- Click Through Rate: If you’re providing links to a dummy landing page or an MVP site, and they click, that’s generally a strong sign of interest.

- Open Rate: less interesting, but if the open rate is very low (after 3 touches), that means that either the contact data is bad, these companies have strong SPAM filters, or these people don’t engage with email in a strong way.

It’s important to note that all of the aforementioned can be done very quickly. I recommend only spending a week or two testing whether an idea can be validated. The mantra with startups is to move fast, and it’s better to know right away if an idea is worth your time, or if you need to go back to the drawing board.

Once you have all of your Secondary and Primary research done, take a look at your data, and honestly ask yourself if there is a strong business opportunity here.

- Is there a significant pain point that needs to be solved with technology?

- Are there existing competitors that would be too threatening to overcome?

- Are there viable channels for reaching your target users?

When you’re feeling confident that your idea has a shot, it’s a good time to invest a little time and resource into building a Minimum Viable Product (MVP), which should be launched immediately. In my next post, I’ll provide some tips for creating and launching an MVP.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

*To my hardware peoples; I didn’t forget about you. As you know, hardware is a different ballgame, and I will be writing a post on How to use Crowdfunding to Validate your Hardware Startup.

**This post is primarily intended for a first time founder audience. If you’re a seasoned founder, please help contribute by posting your tips, tricks, and best practices in the comments section. Thanks!