A recent B2B International survey* of large businesses serving B2B markets has found optimism among marketers across the US and Europe, many of whom are focusing on brand as a growth driver.

Increasing investment in marketing reflects optimism

The outlook is positive: 57% of survey respondents anticipate marketing budget increases this year, compared with 38% last year who said they were expecting an increase.

Although that optimism is industrywide (no more than 13% expect a decrease in budgets, regardless of the industry group), those in trades and services (e.g., retail, hospitality, transportation, and energy) are more optimistic about their marketing budgets than those in knowledge-based sectors (e.g., IT/technology, financial services, healthcare, and education).

Market research budgets are also set to increase: 49% of respondents anticipate an increase over the next 12 months, versus only 13% expecting a decrease and 38% envisioning no change. That pattern is the same for the US and Europe.

Branding is the top strategy for growth, but most marketers acknowledge brand deficiencies

The most widely deployed marketing strategy is branding: 60% of respondents say they are focusing on initiatives to grow their brands. However, although the importance of branding is recognized, many marketers are facing challenges in building their brands:

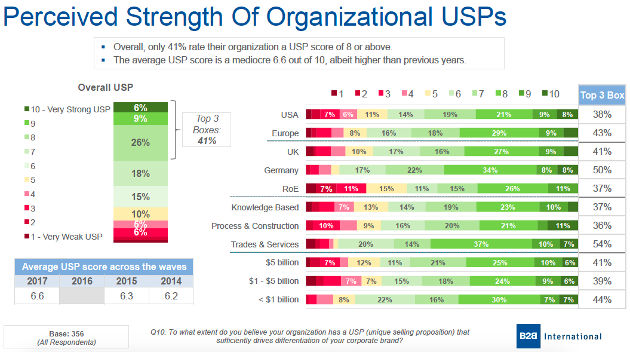

- Only 41% of respondents say their organization has a strong USP (unique selling proposition).

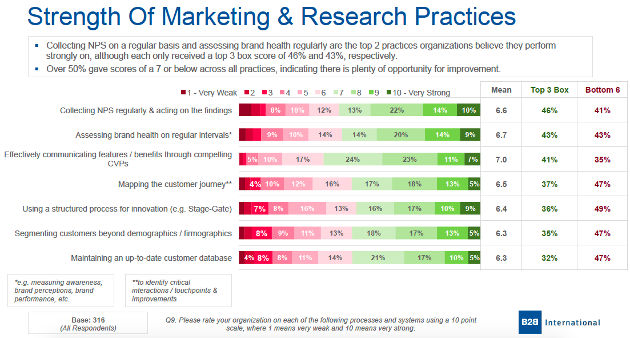

- Only 43% perform well in assessing their brand health at regular intervals (e.g., measuring awareness, brand perceptions, brand performance).

Those in trades and services rate their brand performance higher than those in other industry groups do—possibly a reflection of investment in their brands, since this industry group is also the most positive about marketing budget increases.

A strong brand is a major asset to a company because it drives appeal and value. Some 42% of marketers and corporate researchers say brand research is among the most useful types of research to invest in within the next two years. That’s especially true of those in the US, where half (49%) consider brand research to be of high value to their organization.

Innovation is the lifeblood of success, but a challenge to many

Customer satisfaction and product development are tied in second place as marketing strategies that B2B marketers and corporate researchers are addressing, especially those in process (e.g., manufacturing) and construction sectors.

Innovation is clearly recognized as a key growth driver since it directly impacts the bottom line, but it is also consistently the first- or second-ranked, challenge faced by businesses each year. Only 36% of organizations rate their performance an 8 out of 10 or higher on having a structured process to innovation (e.g., Stage-Gate), suggesting that most businesses lack a systematic approach to ideation, concept development, and product assessment.

Acknowledging the need to improve, 36% of organizations in the US and Europe consider product development research among the most useful types of research studies to their business within the next two years.

Customer satisfaction is vital; it keeps marketers awake at night

Over half (55%) of organizations are focusing on marketing strategies to improve customer satisfaction, especially those in trades and services sectors. That focus is likely a result of the increasing importance of customer-centricity: Fully 50% of businesses say retaining customers is a top challenge.

In today’s economy, suppliers are frequently pressured by growing customer demands, and the threshold for delighting customers seems to stretch higher and higher. Furthermore, with their increasing marketing budgets, marketers are vying for the attention and loyalty of buyers who are often overwhelmed by the many brand and product choices available to them.

B2B marketers admit to weaknesses in how their organizations are tackling the need to become more customer-centric:

- Less than half (46%) of businesses perform well in collecting NPS (Net Promoter Score) regularly and acting on the findings.

- Only 37% map the customer journey to identify critical interactions or touchpoints and improvements.

- Only around one-third (32%) maintain an up-to-date customer database.

Not surprisingly, organizations are considering market research to address those challenges. Some 53% say customer experience and customer journey mapping research will be useful to their organization within the next two years, and 47% acknowledge the need to focus on the fundamentals of customer satisfaction and loyalty surveys.

Clearly, there is substantial opportunity for B2B marketers to invest in the voice of the customer. Based on current strategies and challenges, organizations should place priority on the following:

- Building more distinct brand positions and measuring brand health

- Identifying unmet needs and the potential for enhanced or new products

- Measuring the pulse of customer satisfaction while seeking to achieve customer experience excellence

*About the survey: The research comprises a longitudinal online survey (annual waves) conducted by B2B International; the most recent wave was fielded in October and November of 2017. The total sample size was n=356 (57% in Europe and 43% in the US) and comprised large businesses (the average business revenue was $3.05 billion). All respondents were required to have a responsibility for marketing or research.

–

This article first appeared in www.marketingprofs.com

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +9714 3867728 or mail: info@groupisd.com or visit www.groupisd.com