Luxury retailers and brands are having trouble keeping up with millennials’ demand for instant-gratification brought on by digital advancements.

Global financial markets are seeing significant instability, causing luxury brands to see a decrease in growth. China’s market is experiencing a slowdown, but its consumers make up a third of the global market, with European purchasing being dominated by Chinese tourists.

“The luxury market is experiencing a significant slowdown due to market volatility and instability across global financial markets,” said Roberto Bonacina, transactions advisory services partner for fashion and luxury atErnst and Young. “Underperformance of key markets and a shift to global pricing signal limited future growth opportunities for luxury.

“However, the purchasing power of millennials and growth of online is set to shape the market in years to come,” he said. “Therefore the market will continue to grow, albeit at a slower pace.”

“Notwithstanding a slowdown in the Chinese market, Chinese consumers account for one-third of the global market. The majority of purchases made by Chinese tourists were made in European markets, with only one–fifth made in Mainland China.

“It is also interesting that Japan came out as the top performing area for the luxury goods market, with 9 percent growth in 2015 – mainly due to FX effects and purchases made by Chinese consumers.”

Market shift

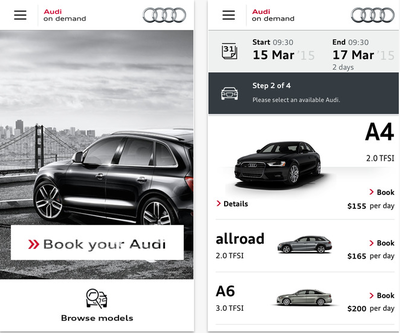

As many brands lunge to adapt to the digital world, the luxury market is behind. Retail and online shopping have drastically shifted due to emerging technology.

The volatile market and constant innovation are difficult for luxury brands that often have a long-standing history and value exclusivity. Luxury brands have to work to balance time-honored traditions while adapting to the new world by offering instant-gratification capabilities to keep up with consumer expectations.

A surge in discount retail startups, ready-to-wear brands and affordable fashion manufacturers are proving to be a threat to high luxury fashion brands and are gaining market share. These new companies are able to offer competitive fashion available for immediate purchasing and affordable pricing.

Luxury fashion brands must focus on making sure their products are competitively exclusive and emphasize the rarity within their marketing efforts.

Balancing new luxury

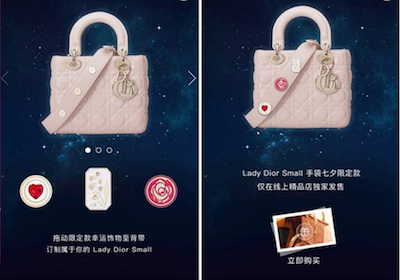

Maintaining that balance between sticking to the nature of the luxury business while adapting to the digital era is vital. With bricks-and-mortar sales continuing to decline, social selling is poised to alter the current retail model by facilitating purchases seamlessly through branded communication.

For instance, French atelier Christian Dior recently tried its hand at social selling by offering its followers on Chinese messaging and social application WeChat the opportunity to purchase a limited-edition handbag directly through a post. While not alone in its WeChat efforts, Dior has become the first luxury house to sell a high-end handbag through the app, showing its potential for direct-to-consumer sales (see more).

Also, London’s Regent Street saw an uptick in consumer engagement and in-store purchases after the high street adopted a dedicated mobile application.

The Regent Street shopping app aggregates exclusive and personalized content for shoppers based on user-generated profiles tailored by individual consumers’ preferences and likes. In addition to consumer profiles, the app, powered by autoGraph.me, relies on beacons to provide users with personalized shopping (see more).

“Companies must take time to get to know the consumer better to understand how best to engage with them,” Mr. Bonacina said.

“The consumer is more sophisticated than ever and companies need to innovate by increasing their digital capabilities to offer instant gratification on unique products,” he said. “Price positioning is also crucial, never more so than today when consumers respond well to the transparency offered by digital channels.

“At the same time, it is important that companies defend the luxury experience by demonstrating that they can offer the same level of experience that luxury consumers have become accustomed to.”

This article first appeared in www.luxurydaily.com