There’s a new acronym being used in investing circles: BANG. It stands for Blackberry, AMC, Nokia, and Gamestop, four companies that have come to embody the phenomenon of meme stocks, or stocks that gain traction and investors largely through social media hype.

This social media meme culture meets retail investing has exploded over the last year, thanks to a pandemic-fueled surge in popularity of apps that make it easy for people to invest. Individual investors opened more than 10 million investment accounts in 2020, and that only intensified at the start of this year.

Amid this volatility, fintech startup Public is launching its first-ever brand campaign and new brand identity that pitches the app as a place to balance the current retail investment hype with community and long-term stability. “People might come to invest in GameStop, but after using the product, are they building a proper portfolio?” asks co-CEO Leif Abraham. “That’s our focus. It’s about building long-term investors, not just people who want to gamble on a quick stock. It’s about making the stock market a consumer product, but not purely from the speculative side, also from the side of building proper portfolios.”

In January, thanks to hype on forums like Reddit’s WallStreetBets, Gamestop’s stock surged by 1,600%, and AMC’s stock is up 2,400% this year. The movie chain bought into the hype this week by offering investors free popcorn. Retail investing online, where non-professional people buy and sell securities through brokerage firms, has been popular since the original dotcom boom—remember the E-Trade monkey?—but this new wave hit amid a convergence of mobile apps and social media virality.

Public has positioned itself as what it calls a “social investing app,” which allows users to follow others’ portfolios while also getting analyst information for companies and industries. Abraham uses a gym metaphor to describe it as the investing equivalent to having a personal trainer and gym buddies to help motivate you. It launched in September 2019 and raised $220 million in February, which boosted its valuation to $1.2 billion.

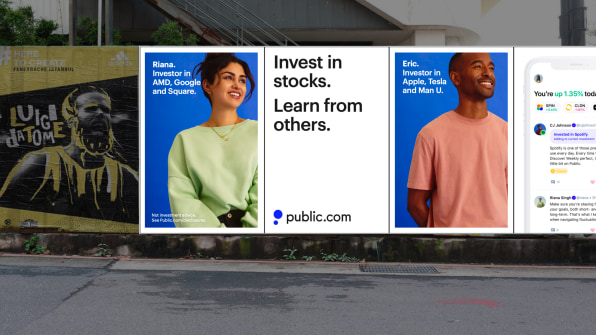

The new campaign, created with New York-based agency Works, features photos of actual Public users and a snapshot of their portfolios. We see Millana, who invests in Tesla, Google, and Zoom; Mick, who invests in Shopify, Twitter, and Farfetch; and Riana, who invests in AMD, Google, and Square. The models are cool, young, and diverse, and the ads use Helvetica font and plenty of white space, which gives them an American Apparel vibe, without all the sex.

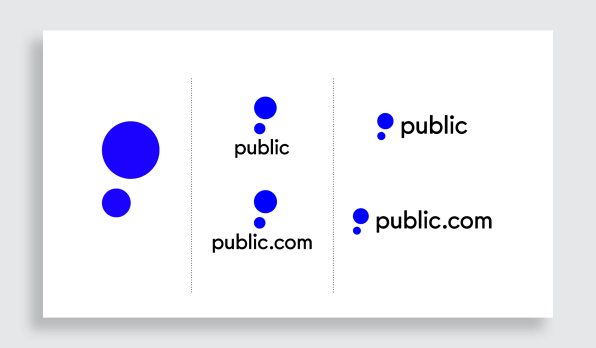

The new logo, designed by Studio Mococo, has two simple, blue circles of different sizes. Studio Mococo cofounder and executive creative director Martin Grasser says the goal was to build an identity that embodied the goal of the product. “At its core, Public’s differentiation lives with its diverse community,” says Grasser. “In the new logo and brand system the two circles remind us of the friendly chat bubbles we all know and love, while also invoking a metaphor for financial growth. Together they also make a P and nod to the company name.”

Meme stock hype has been coupled with a certain bro-ey culture, the inside jokes and slang of WallStreetBets, and the confetti-bursting gamification of investing on Robinhood. Abraham says this campaign’s purpose is to illustrate how Public is different. According to Public, its more than 1 million users are 40% women, 45% POC, 90% first-time investors, and 90% long-term investors. “You might come from Twitter or Reddit learning about AMC and Gamestop, and then Public introduces you to a different investing culture,” says Abraham.

It belies another big difference between Public and many other popular retail investing apps, which is that Public doesn’t rely on the somewhat controversial payment for order flow (PFOF) model, which essentially incentivizes apps to push users to invest as much and as often as possible, focusing on quantity over quality. In December, Robinhood agreed to pay a $65 million Securities and Exchange Commission (SEC) fine to settle charges that it misled customers about PFOF. Public dropped PFOF from its business in February.

Just as Public encourages its users to balance investing between the trendier meme stocks and a stable, long-term portfolio, the company’s brand work straddles the serious and the silly. To mark ditching PFOF, Public enlisted Michael Bolton to sing about it in a series of goofy digital videos

Abraham’s cofounder and co-CEO Jannick Malling says they see all of the company’s moves as part of its brand communications, which informs everything from the new logo to its investors. “Early on, we took investment from Will Smith, J.J. Watt, and Tony Hawk, and when people see them involved, it helps to build a more mainstream product,” says Malling. “Even recently, we rolled out a feature called Town Hall, which is our version of an AMA, and kind of like a retail version of an earnings call.”

Public’s Town Hall in April featured Lemonade cofounder Shai Wininger, and Bumble founder and CEO Whitney Wolfe Herd. Malling says this is part of the company’s educational component that aims to turn new users into long-term investors. “If you have only action without the education, then it’s all speculative,” says Malling. “But if you have action and meaningful education, then this movement we’re seeing can be a massive force for good.

Abraham says this new generation of investor that’s flooded into the market has a more complex criteria for the companies they want to invest in, one that relies more on business strategy, company culture, and where the world is headed than the most recent quarterly results.

“They’re way more long-term, and also there’s an aspect of voting with your dollars, and where they want to see the world headed,” says Abraham. “It’s a representation of their identity. And that’s something we want to convey with our brand as well.”

…

This article first appeared in www.fastcompany.com

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +971 50 6254340 or mail: engage@groupisd.com or visit www.groupisd.com/story